Think there’s no gender pay gap? Hate to break it to you: there is. But how much of the gap is eliminated when an apples-to-apples comparison is made of all the variables that go into what men and women make? A lot!

A recent enlightening chart shows one of the variables that is often overlooked in reporting about where some of the gap begins.

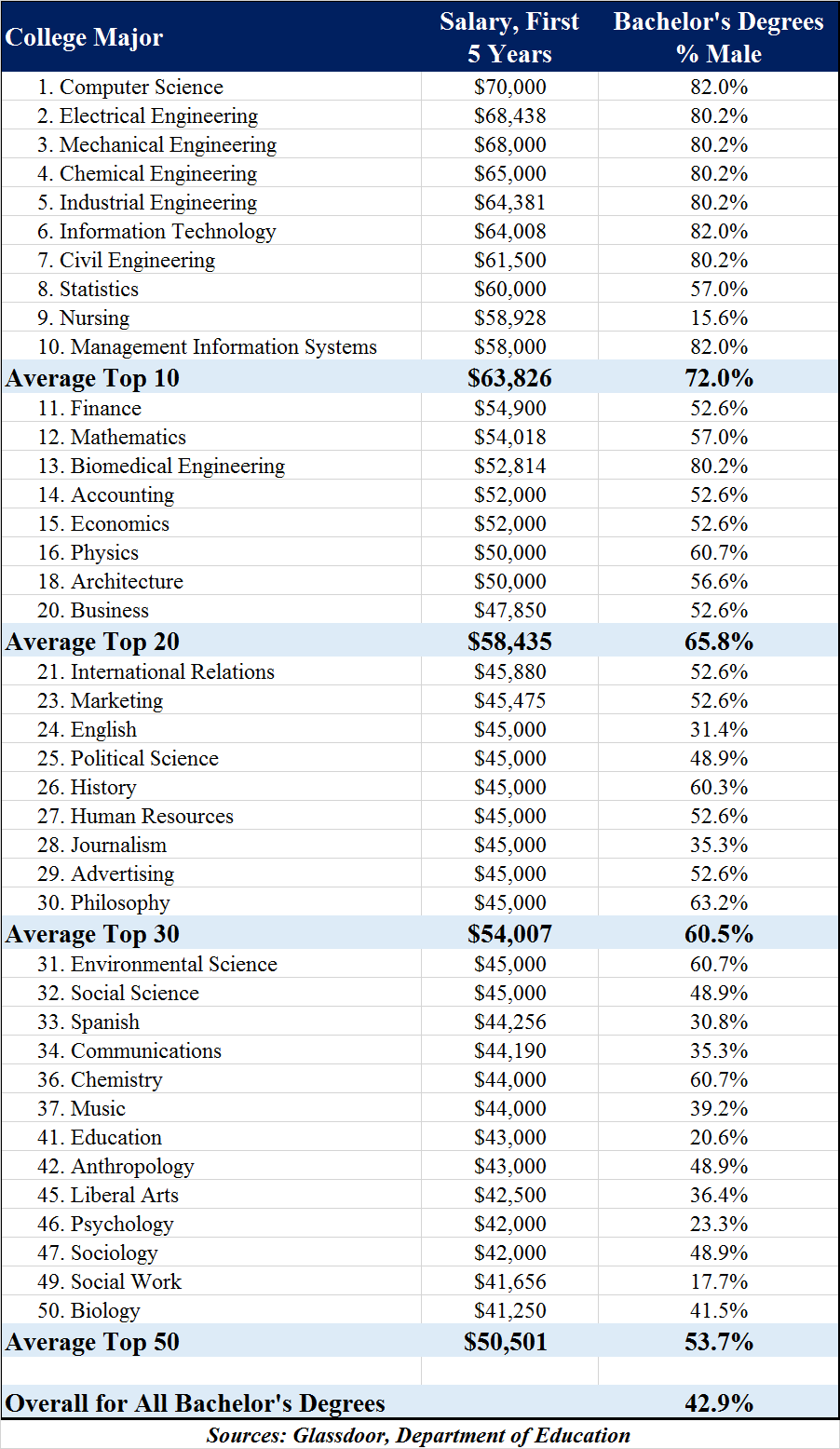

The chart, constructed by economist Mark Perry, borrows from a Washington Post article about the 50 majors that offer the highest paying jobs out of college. The original article pulls from a report by job search engine Glassdoor.

Lo and behold, many of the highest-paying jobs are in fields where women are underrepresented in college graduation rates.

Shocker, right? Women are studying in majors whose fields offer lower-paying wages.

Perry’s comparison is rich in details. For instance, he notes that women earned 57 percent of the bachelor’s degrees in 2014 compared to 43 percent of men who graduated that year, yet men were “significantly over-represented for the highest-paying college majors,” specifically taking at least 80 percent of the degrees in eight of the top 10 highest-paying college majors. The one exception where women were overrepresented in a high-paying career — nursing.

He notes that for the top 20 college majors, men earn an average of nearly two-thirds of those degrees; and 60.5 percent of the degrees for the top 30 highest-paying fields.

Perry, a professor at University of Michigan-Flint, acknowledges that the comparison is complicated by the fact that the Department of Education, from where he pulled the gender data, does not separate out degree fields as carefully as Glassdoor, and doesn’t even list certain degrees that offer high-paying jobs.

For example, the Department of Education only reports the number of bachelor’s degrees by gender for the broad academic field of “engineering,” without any details on engineering degrees in the six sub-fields of engineering reported by Glassdoor (electrical, mechanical, chemical, etc.). Likewise, all of the business-related degrees in finance, accounting, marketing, human resources, advertising, etc. are only reported as bachelor’s degrees in “business” by the government. Economics degrees are included in the category Social Sciences, along with degrees in fields like sociology, anthropology, political science, etc. For some Glassdoor college majors like Fashion Design, Biotechnology, Graphic Design, Film Studies, Sports Management, it wasn’t clear what bachelor’s degrees reported by the Department of Education matched those majors, so I omitted 10 of the 50 college majors, leaving 40 majors in the table above.

The lack of detail by the Department of Education is interesting in itself, and certainly makes it more difficult for the federal government to claim to know the source of gender wage disparity, but Perry argues that the wage gap could be reduced if women chose career fields in the sciences and technical fields, as boring as they may seem to some.